CPAs, you know you’re required to earn a set number of Continued Professional Education (CPE) credits each year to maintain your license. Completing one of Becker’s Consulting Services Libraries would satisfy these requirements and bring you closer to where you want to be in your consulting work. Even if you don’t have a CPA license, investing in yourself and building your skillset through consulting-focused courses is the perfect way to show your firm that you're committed to learning and growing within your role. Hourly rates for accounting consultants range from $27.39 (Tampa, FL) to $44.39 (Washington, D.C.). An ongoing survey by Indeed shows that the average salary for accounting consultants in the United States is $78,960 per year (as of April 2020). Discover how to grow your accounting practice and become a next generation firm through high value advisory services with Practice Forward.

Key Responsibilities of an Accountant Consultant

Because it’s a single-entry system, for example, you won’t find a balance sheet. However, you can view basic reports on profit and loss, taxes, sales, bills and expenses. The free software lets you generate an unlimited number of estimates and invoices and customize them with your business logo. Wave can also generate the most important financial statements (profit and loss, balance sheet and cash flow statement) along with reports on sales tax, payroll, aged receivables and aged payables.

, Dehtiarivska Str., 7th floor, 03057, Kiev (Kyiv), Ukraine.

Consider it if you’re a small business with simple accounting needs that are generally concentrated in sending invoices and collecting payment. You’ll need to choose the paid plan if you want to enable clients to pay online directly through your invoice. Before joining NerdWallet in 2020, Sally was the editorial director at Fundera, where she built and led a team focused on small-business content and specializing in business financing. Karrin Sehmbi is a lead content management specialist on the small-business team. She has more than a decade of editorial experience in the fields of educational publishing, content marketing and medical news.

Cons of Being an Accountant Consultant

- Visit our Global IFRS technical resources for insights and resources to help with the International Financial Reporting Standards (IFRS).

- Of course, the COVID-19 pandemic may affect the profession to a degree, but over the past decade, accountants and auditors have maintained higher employment rates than many other professional positions.

- Specializations can make your services more appealing to certain clients, often allowing you to command higher fees.

- Accounting consultants offer scalability and flexibility that may take work for businesses to achieve on their own.

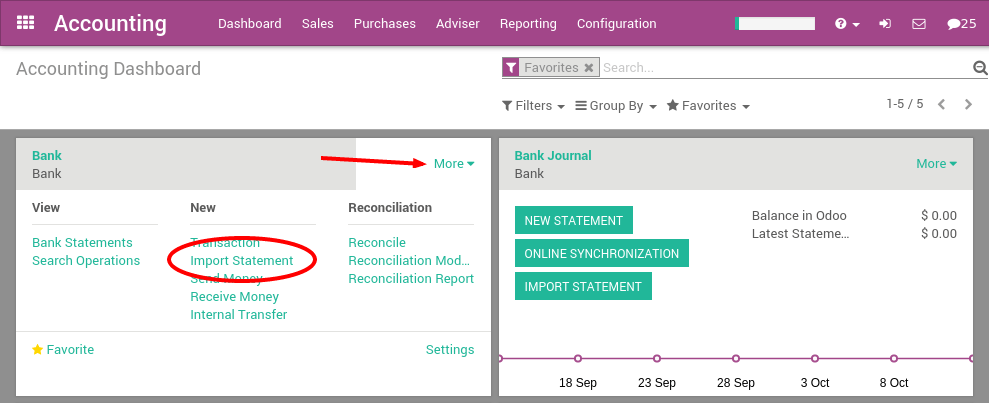

- With Odoo, an unlimited number of users can manage invoices, accounts receivable and accounts payable, bills and cash.

The survey also compared annual accounting consultant salaries by geographic and metro regions. For example, a CPA consultant’s average salary in New York City is $106,000 per year, invest in tax free municipal bonds for lower taxes and risk while in Bethesda, MD, the annual salary averages $74,000. Additionally, forensic accounting, internal audits and accounting system evaluation are among the more in-demand skills.

Free plan includes direct integration with Square and PayPal for payment processing. Consider it if you prefer to do your work on a Mac and/or if you already use Square or PayPal to accept payments, since ZipBooks can seamlessly connect with those platforms to enable online payments with your invoicing. CPA Practice Advisor is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. At EY, you’ll have the chance to build a career as unique as you are, with the global scale, support, inclusive culture and technology to become the best version of you. Visit our Global IFRS technical resources for insights and resources to help with the International Financial Reporting Standards (IFRS). The Better Finance podcast explores the changing dynamics of the business world and what it means for finance leaders of today and tomorrow.

Communication and Interpersonal Skills

Finance teams can learn from the experience of their peers who have already filed 2020 accounts during the pandemic. Private company CFOs are change agents, stewards of long-term value and technology leaders, but need to improve their people skills. Investors are pursuing green recovery opportunities, but a long-term strategy could be needed to avoid a market bubble. The EY Global Corporate Reporting and Institutional Investor Survey finds a significant reporting disconnect with investors on ESG disclosures. Asking the better questions that unlock new answers to the working world's most complex issues. Being adaptable and flexible is necessary with ever-changing client needs, industry trends, and regulatory environments.

Accounting consultants help businesses navigate these complex regulatory landscapes, advising on tax preparation, adherence to financial reporting standards, and understanding and complying with relevant business laws. Your accounting needs might be modest today, but they may not stay that way forever. If you think your business will grow in the future, make sure your accounting software offers higher-tier plans or add-ons that can scale with your company. These ratings are meant to provide clarity in the decision-making process, but what’s best for your business will depend on its size, growth trajectory and which features you need most. We encourage you to research and compare multiple accounting software products before choosing one.NerdWallet does not receive compensation for any reviews. Inventory aside, you can choose from a variety of invoice templates, add custom fields and automatically calculate taxes.

Their unique skill set makes them valuable assets to any organization, keeping their services in high demand. They compile detailed financial reports and explain their findings to executives and key stakeholders. Their insights can influence business decisions, strategies, and growth plans. While formal education and certifications provide the theoretical foundation and professional legitimacy, practical skills, and experience make an accountant consultant genuinely effective. It involves a purposeful journey that combines rigorous academic studies, professional certifications, hands-on experience, and the development of a diverse skill set. In business and finance, an accountant consultant is a pillar of strategic guidance and financial wisdom.

These individuals hold an in-depth understanding of accounting principles and how to apply them in various business scenarios. An accounting consultant ensures that businesses adhere to financial regulations, conducting regular audits and helping prepare for external audit evaluations. Their knowledge, experience, and guidance provide significant value to businesses, making them an essential part of any organization's financial strategy. Accounting consultants are tasked with preparing and presenting detailed financial reports. These reports offer comprehensive insights into an organization's financial standing, facilitating informed decision-making. They work closely with businesses to set realistic financial goals, optimize the use of resources, and develop strategic plans for future financial activities.

If communication channels are not clear and compelling, it could lead to misunderstandings and inefficiencies.

When you provide accounting consulting services, you do more than make sure the numbers add up. As a CPA consultant, you analyze the numbers and trends and provide thoughtful, detailed insight to improve your client's business going forward. If you succeed in forging a path to your client's growth, you also create a solid footing to continue working with them long-term as a business partner and advisor.

An accounting consultant is a professional who provides guidance and advice to businesses on financial matters. They help businesses to manage their finances more effectively and make better decisions about how to use their money. They can provide you with the insight and guidance you need to make sound financial decisions, while also helping you to save money in the long run. When looking for an accounting consultant, it is important to consider their qualifications, experience, and cost.

Niching can also help you set your rates by providing a clear rationale for the value you bring to the table. Potential clients will want to see proof of your expertise and ability to deliver results. So, unless you’re working for an established accounting consultancy, becoming an independent consultant will usually require you to have at least a few years of experience under your belt. If you’re wondering how to transition into https://www.kelleysbookkeeping.com/, you’re in good company. It’s fairly common for CPAs to become part-time or full-time consultants just prior to retirement, while others enjoy the benefits of greater flexibility and control over their schedules earlier in their careers. Units Consulting Ltd., Accounting & Payroll firm (Kiev, Ukraine) was founded in 2000 by a team with years of experience in audit, accounting and tax consulting as a national, independent certified accounting firm.

When working as an accounting consultant, you can take your expertise a step further. Finance Strategists has an advertising relationship with some https://www.business-accounting.net/irs-enrolled-agent-salary/ of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site.